Report | 2023

Peak Fossil Fuel Demand for Electricity

It’s all over except the shouting

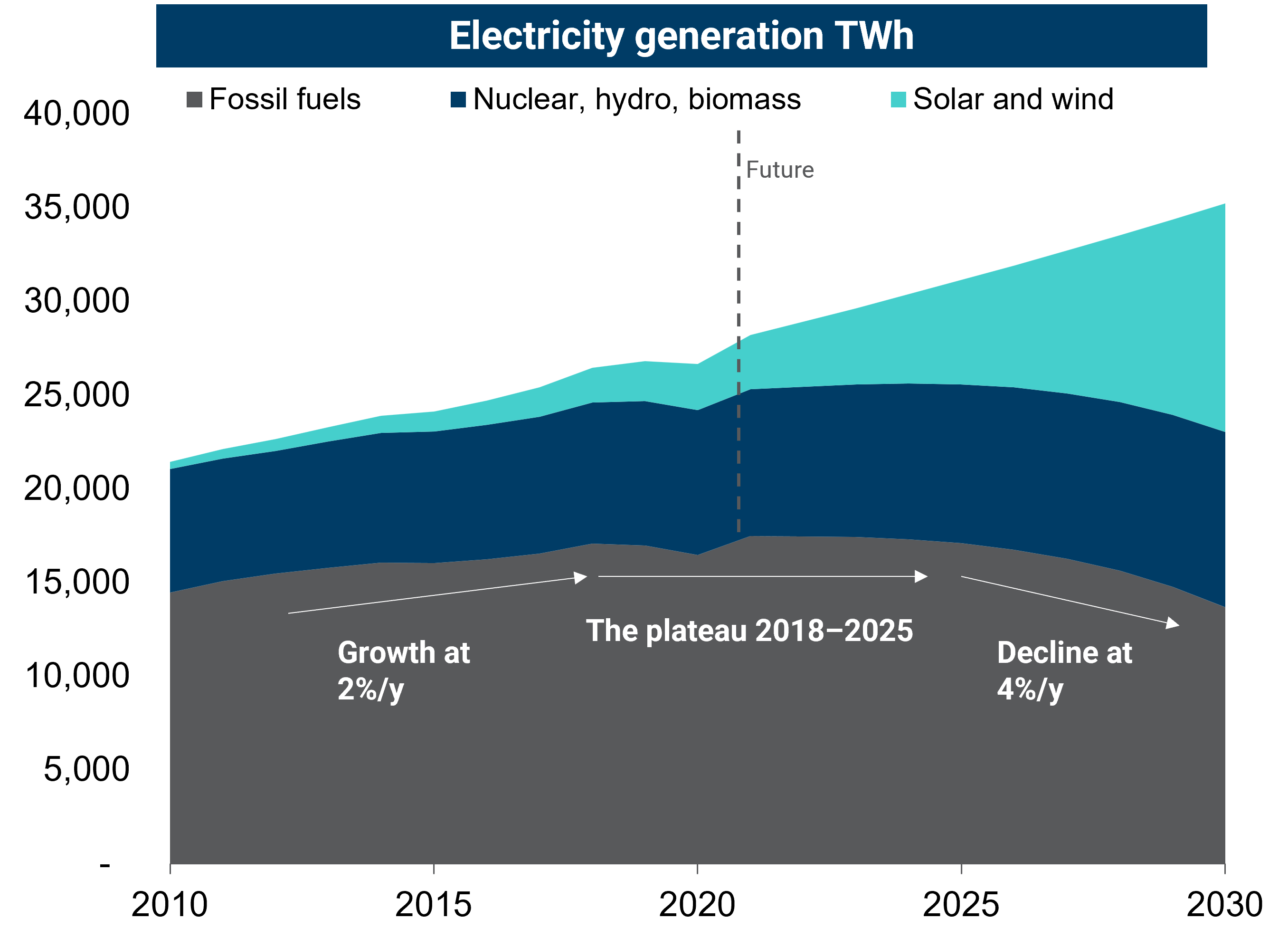

The latest installment of The Peaking Series shows demand for fossil fuels has peaked in the electricity sector. It will plateau for a few years and be in clear decline by the second half of the decade.

The key driver of change is the rapid growth of solar and wind electricity generation on typical S-curves, driven by low costs, a shift of global capital, and the rising ceiling of what is possible.

In 2022, solar and wind will produce 600–700 TWh of new electricity. Added to the 100–200 TWh from other clean sources makes it enough to meet projected global electricity demand growth of around 700 TWh.

The story just gets better and better as solar and wind advance further up the S-curve. Solar and wind generation will increase at least threefold by the end of the decade, pushing fossil fuel electricity into terminal decline.

This is a global phenomenon. Fossil fuel demand for electricity has peaked in 95 percent of the OECD countries and 31 percent of the non-OECD countries excluding China. Chinese demand is about to peak as the 2030 renewable deployment goals are hit before 2025. India is choosing its own path to development, based on growth from renewables. And renewables offer new solutions for Africa.

There are plenty of barriers to change, but none of them are insoluble, immediate, and universal so cannot maintain the status quo. The ceiling of change is far above our heads and disruption of the incumbent fossil fuel system is thus inevitable.